Working with partners in China is complex because of unfamiliar financial rules and the Fapiao tax receipt system.

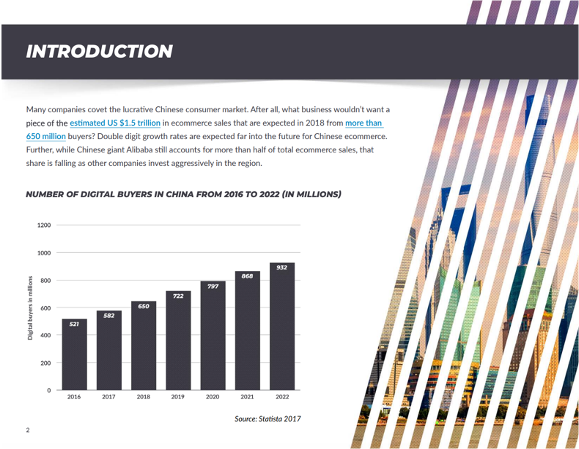

Many companies covet the lucrative Chinese consumer market. After all, what business wouldn’t want a piece of the estimated US $1.5 trillion in ecommerce sales that are expected in 2018 from more than 650 million buyers? Double digit growth rates are expected far into the future for Chinese ecommerce. Further, while Chinese giant Alibaba still accounts for more than half of total ecommerce sales, that share is falling as other companies invest aggressively in the region.

In short, there’s major opportunity. But to sell goods and services in the region, and make payments to partners, they need to understand and adhere to the Fapiao tax receipts system -- a central element of the tax system throughout China.

This ebook simplifies Fapiao and explains how this prepaid tax system impacts advertisers and affiliates. Download this ebook and learn:

- The basics of the Fapiao system

- How Fapiao impacts advertisers and their obligations

- How Fapiao affects partners and their obligations

- What to look for in a payments solution for China that addresses Fapiao

- Much more!

China is too big an opportunity to overlook. Download this informative ebook and learn what you need to know about Fapiao -- all in about 15 minutes. Get immediate access by filling out the form.